US Bank recently launched a new online bill-pay service. This replaces AFTS' web payment option. Due to data security issues, this service was discontinued recently. All payment processing has been transferred to US Bank by the Port of Long Beach. US Bank bill payment service offers multi-step verification and a password. It's safe and simple to use. US Bank billpay offers convenient payment options and is a great option to make online payments.

Online bill payment

US banks offer a wide variety of services for online bill payment. These services allow you control all of your bills online, via an app, mobile app, or SinglePoint(r). Essentials. Bill payment can be simple and quick, and there are many ways to set up automatic payments and minimum payments. After you have created an account, you are able to start paying your bills. If you'd prefer not to use an online bill pay service, check out the following benefits of online bill payment.

You only need to follow a few easy steps to sign-up for online bill payments. Log in to your bank's website. Click on Bill Pay, and then enter the information for your payee. Copy and paste the information from a biller into the form to make the first payment. Next, enter what amount you wish to make and when you want it to be paid. You can schedule recurring payments or set up eBills.

Benefits

U.S. Bank Bill Pay makes it simple to pay your bills. You can access it via mobile banking, online banking, or SinglePoint(r), Essentials. Any bill can be paid with your mobile phone. US Bank bill pay is a mobile payment system that eliminates the need to mail a check, send a stamped envelope or visit the mailbox. You can even pay your bill directly from you bank account. There are many benefits to US bank bill pay.

Online bill paying offers many benefits, including convenience. You won't lose your payment envelope or check. Also, you can view all your bills from anywhere. Online payments provide the highest level data protection. There is the risk of identity theft when payments are sent to multiple businesses. Online bill pay eliminates identity theft risk by removing the need to log into multiple sites. You can access your information at any time.

Process

U.S. Bank bill payment is an excellent feature of both online and mobile banking. You can easily send money to any U.S. mail address by just clicking a few buttons. You can send money to virtually any U.S. postal address with just a few clicks. You can also use this service to make mobile payments. Follow the instructions to download the bill payment app.

FAQ

Can I get my investment back?

You can lose everything. There is no guarantee that you will succeed. However, there are ways to reduce the risk of loss.

Diversifying your portfolio is one way to do this. Diversification helps spread out the risk among different assets.

You can also use stop losses. Stop Losses are a way to get rid of shares before they fall. This reduces the risk of losing your shares.

You can also use margin trading. Margin Trading allows the borrower to buy more stock with borrowed funds. This increases your profits.

How can I invest wisely?

An investment plan should be a part of your daily life. It is essential to know the purpose of your investment and how much you can make back.

You must also consider the risks involved and the time frame over which you want to achieve this.

This will help you determine if you are a good candidate for the investment.

Once you've decided on an investment strategy you need to stick with it.

It is better to only invest what you can afford.

Is it really a good idea to invest in gold

Since ancient times, gold is a common metal. It has remained a stable currency throughout history.

Gold prices are subject to fluctuation, just like any other commodity. When the price goes up, you will see a profit. You will lose if the price falls.

You can't decide whether to invest or not in gold. It's all about timing.

How can I grow my money?

You need to have an idea of what you are going to do with the money. It is impossible to expect to make any money if you don't know your purpose.

You also need to focus on generating income from multiple sources. This way if one source fails, another can take its place.

Money does not come to you by accident. It takes planning and hardwork. You will reap the rewards if you plan ahead and invest the time now.

Do I need to buy individual stocks or mutual fund shares?

The best way to diversify your portfolio is with mutual funds.

However, they aren't suitable for everyone.

If you are looking to make quick money, don't invest.

You should instead choose individual stocks.

Individual stocks offer greater control over investments.

In addition, you can find low-cost index funds online. These allow you to track different markets without paying high fees.

At what age should you start investing?

The average person spends $2,000 per year on retirement savings. You can save enough money to retire comfortably if you start early. If you wait to start, you may not be able to save enough for your retirement.

You need to save as much as possible while you're working -- and then continue saving after you stop working.

The sooner that you start, the quicker you'll achieve your goals.

Consider putting aside 10% from every bonus or paycheck when you start saving. You might also be able to invest in employer-based programs like 401(k).

Contribute enough to cover your monthly expenses. After that you can increase the amount of your contribution.

How much do I know about finance to start investing?

No, you don’t have to be an expert in order to make informed decisions about your finances.

All you need is common sense.

These are just a few tips to help avoid costly mistakes with your hard-earned dollars.

First, be cautious about how much money you borrow.

Don't put yourself in debt just because someone tells you that you can make it.

Make sure you understand the risks associated to certain investments.

These include inflation, taxes, and other fees.

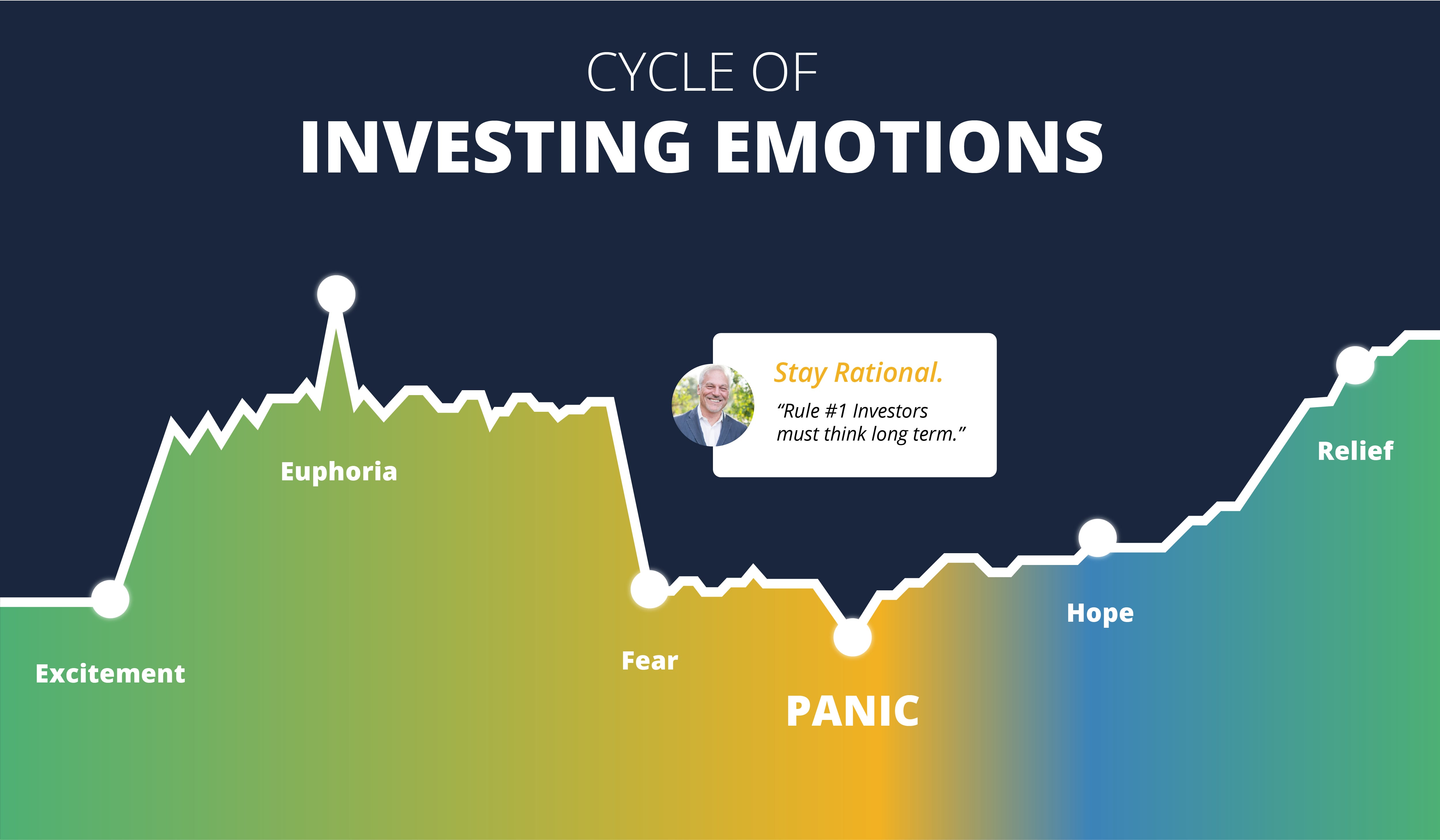

Finally, never let emotions cloud your judgment.

Remember that investing is not gambling. To succeed in investing, you need to have the right skills and be disciplined.

This is all you need to do.

Statistics

- Some traders typically risk 2-5% of their capital based on any particular trade. (investopedia.com)

- According to the Federal Reserve of St. Louis, only about half of millennials (those born from 1981-1996) are invested in the stock market. (schwab.com)

- An important note to remember is that a bond may only net you a 3% return on your money over multiple years. (ruleoneinvesting.com)

- Most banks offer CDs at a return of less than 2% per year, which is not even enough to keep up with inflation. (ruleoneinvesting.com)

External Links

How To

How to start investing

Investing means putting money into something you believe in and want to see grow. It's about confidence in yourself and your abilities.

There are many options for investing in your career and business. However, you must decide how much risk to take. Some people are more inclined to invest their entire wealth in one large venture while others prefer to diversify their portfolios.

These are some helpful tips to help you get started if you don't know how to begin.

-

Do your research. Do your research.

-

Be sure to fully understand your product/service. Be clear about what your product/service does and who it serves. Also, understand why it's important. You should be familiar with the competition if you are trying to target a new niche.

-

Be realistic. Consider your finances before you make major financial decisions. If you can afford to make a mistake, you'll regret not taking action. But remember, you should only invest when you feel comfortable with the outcome.

-

Do not think only about the future. Take a look at your past successes, and also the failures. Ask yourself whether you learned anything from them and if there was anything you could do differently next time.

-

Have fun! Investing shouldn’t be stressful. Start slowly and gradually increase your investments. Keep track and report on your earnings to help you learn from your mistakes. Keep in mind that hard work and perseverance are key to success.